Case Study: Designing Splitwise Pay & Card – Driving Revenue Through Embedded Fintech

Overview

When I joined Splitwise as a Product Designer, Splitwise had millions of users splitting bills with friends and roommates, but monetization was still relatively lightweight. My work centered on helping launch Splitwise Pay and the Splitwise Card — new financial products designed to streamline debt settlement and grow company revenue.

The Problem We Were Solving

Splitwise users loved tracking expenses, but when it came time to settle up, most left the platform, switching to Venmo, Cash App, or bank transfers. This meant lost engagement, fractured UX, and a missed business opportunity.

The challenge: how do we make paying each other directly in Splitwise not just possible, but preferable?

My Approach

Designing Splitwise Pay

I collaborated closely with product, engineering, and compliance teams to design Splitwise’s first in-app peer-to-peer payment flow.

- Integrated payment directly into the “Settle Up” flow users were already familiar with

- Designed for edge cases: partial payments, cross-platform access, confirmation flows, and linked bank accounts

- Focused on trust: used clear UI affordances, microcopy, and status indicators to reduce user anxiety around “real money” transfers

We tested early versions with internal teams and a small user cohort before scaling. My focus was on reducing friction — making Splitwise Pay feel as seamless as sending a Venmo, without leaving the app.

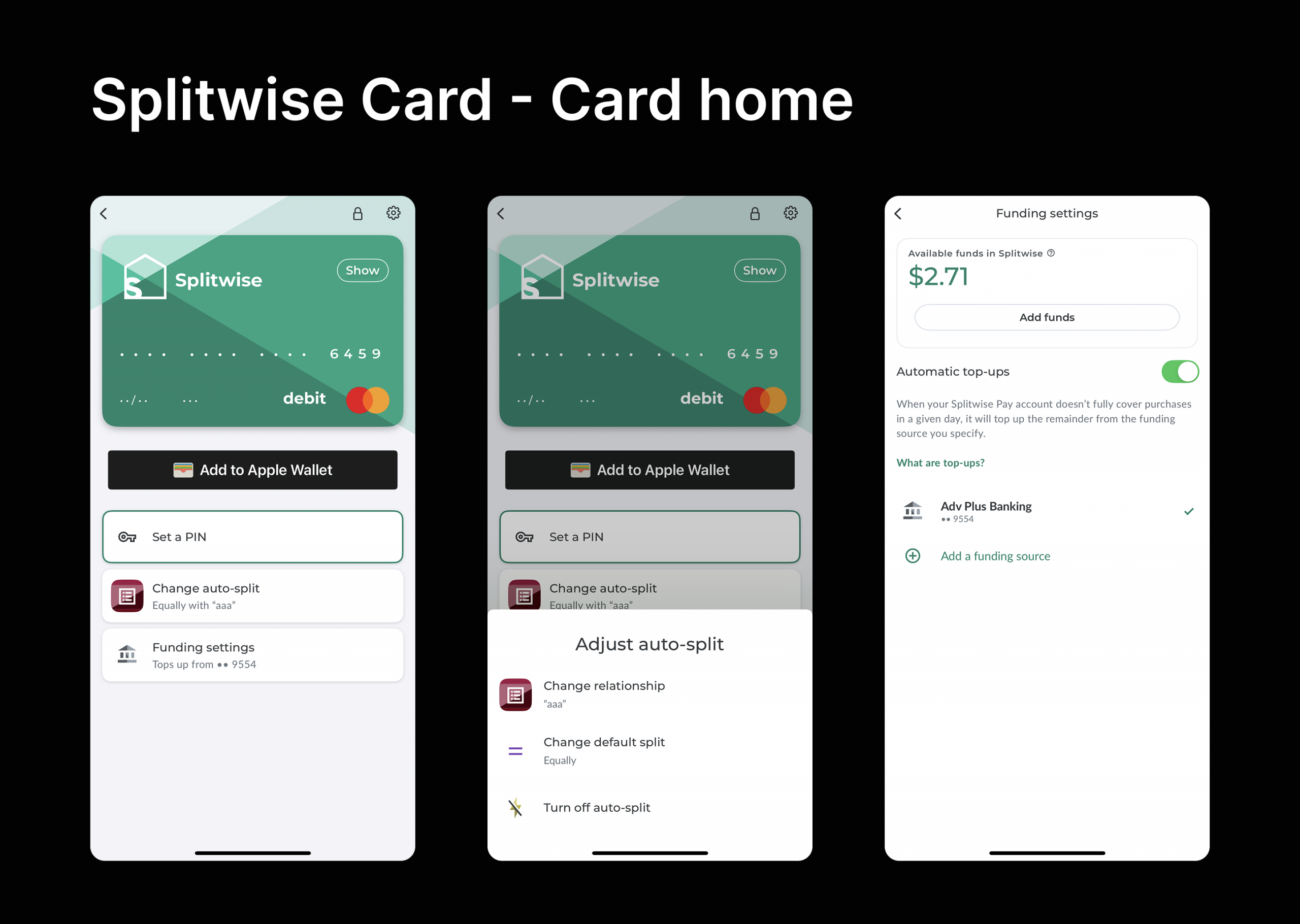

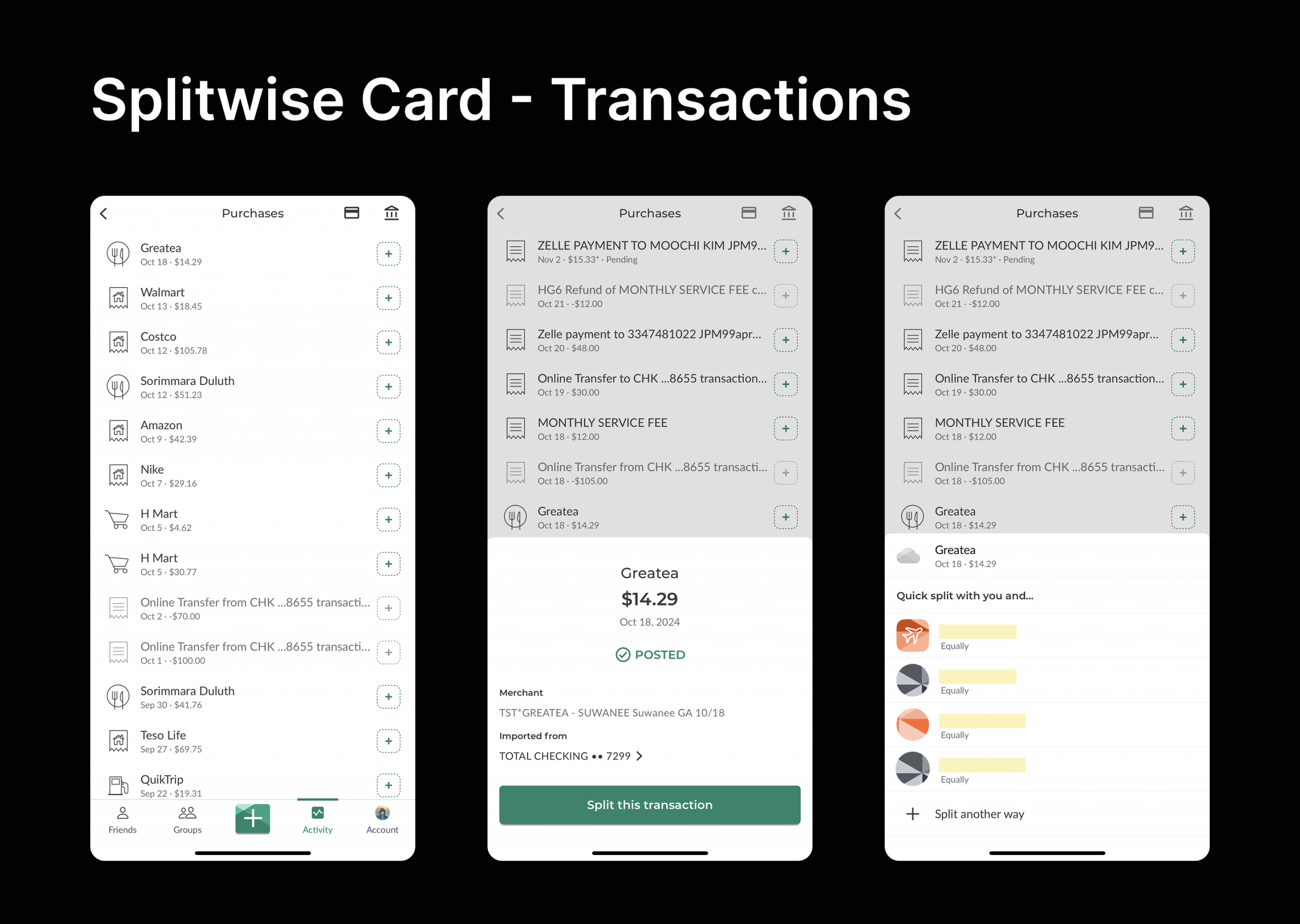

Supporting the Splitwise Card Launch

Later, I helped the team explore and support the launch of the Splitwise Card, a debit card that automatically splits shared purchases.

- I worked on the visual and UX integration of card management into the app

- Designed onboarding and educational moments to explain how the card fits into the user’s existing habits

- Collaborated with data and marketing to ensure the card’s value proposition was clearly communicated

Why I Made These Decisions

Every decision was tied to two goals: ease of use and user confidence. Payments introduce a level of seriousness that expense-splitting didn’t previously have, so my designs emphasized clarity, predictability, and confirmation at every step.

One challenge was designing around backend constraints (e.g., ACH processing times, transaction failures). I partnered with engineers early to model what the edge cases looked like and made sure our UX accounted for loading states, retries, and support pathways.

Defining Success

Rather than focus only on revenue metrics, I helped define product-specific success metrics such as:

- Conversion rate from "Settle Up" to payment

- User drop-off before vs. after the Pay introduction

- Rate of payment completion without user error or support tickets

From a user experience lens, success meant fewer dead ends and more full-circle settlements — from expense → to payment → to resolution.

Outcomes & Impact

The launch of Splitwise Pay gave users a reason to stay within the app longer, complete their workflows, and trust Splitwise not just as a tracker, but as a financial facilitator. It laid the foundation for future monetization efforts and helped prove that the company could build financial products that users were willing to adopt.

The card work supported this broader vision, extending the Splitwise brand into real-world purchases while staying true to the core use case: shared expenses made simpler.

Final Reflection

Splitwise taught me how to design financial flows that are lightweight but high-trust, and how to collaborate across disciplines — from compliance to marketing — to ship complex features. Working on monetization also gave me a new appreciation for aligning user value with business impact. I walked away more confident in designing for both.